rhode island state tax withholding

WEEKLY - If the employer withholds 600 or more for a calendar month. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding.

Solved I M Being Asked For Prior Year Rhode Island Tax

Subtract the nontaxable biweekly Thrift.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

. Your payment schedule ultimately will depend on the average amount you hold from employee wages over time. Ad Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding.

An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a RI state return. In Rhode Island there are five possible payment schedules for withholding taxes.

Personal income tax forms contain a 1D barcode. The wage table has been updated. However if Annual wages are more than 231500 Exemption is 0.

Rhode island income tax withholding Thursday March 3 2022 Edit. State of Rhode Island. A the employees wages are subject to Federal income tax withholding and b any part of the wages were for services performed in Rhode Island 280-RICR-20-55-106C1.

Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if. Nonresident Real Estate Withholding Forms. To be filed with the Division of Taxation on or before the 20th day of the succeeding month except fo r the months of March June September and December may be filed by the last day of the following month.

The Amount of the Rhode Island Tax Withholding Should Be. An employer may withhold Rhode Islands personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding. The additional amount of Rhode Island income tax withholding is entered on line 2 of Form RI W-4.

All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format To have forms mailed to you please call 4015748970. RI Employer Tax Section 401-574-8700 Option 1 - unemployment and TDI. Income tax withholding account including withholding for pensions or trusts Rhode Island Unemployment insurance account including Rhode Island temporary disability insurance TDI and Rhode Island job development fund tax.

Rhode Island State Income Taxes for Tax Year 2021 January 1 - Dec. 5 rows Withholding Formula Rhode Island Effective 2021. Employers must report and remit to the Division of Taxation the Rhode Island income taxes they have withheld on the following basis.

File Scheduled Withholding Tax Payments and Returns. Exemption Allowance 1000 x Number of Exemptions. RI Division of Taxation Registration Section 401-574-8829 - withholding and sales tax registration only questions.

Subtract the nontaxable biweekly Thrift. Additionally employers in other states may wish to withhold Rhode Island income taxes from wages of their Rhode Island employees as a convenience to those employees. No action on the part of the employee or the personnel office is necessary.

If you already have a portal account and need assistance navigating the tax portal please view our Portal User Guide by clicking HERE. 5 rows Withholding Formula Rhode Island Effective 2022. Daily quarter-monthly monthly quarterly and annually.

The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format To have forms mailed to you please call 4015748970 Withholding tax forms now. However if Annual wages are more than 215800 Exemption is 0.

Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. REPORTING RHODE ISLAND TAX WITHHELD. 50 or more but less than 600 withheld each month 941-M-RI.

The income tax withholdings for the State of Rhode Island will include the following changes. Additionally employers in other states may wish to withhold Rhode Island personal income tax from wages of their Rhode Island employees as a convenience to those employees. The income tax is progressive tax with rates ranging from 375 up to 599.

Welcome Administering RI state taxes and assisting taxpayers by fostering voluntary compliance through education and. Employers are not required to determine the correctness of the withholding allowance certificates and may rely on the number of state withholding exemptions claimed on. The annualized wage threshold where the annual exemption amount is 000 will increase from 217350 to 221800.

Exemption Allowance 1000 x Number of Exemptions. Thank you for using the Rhode Island online registration service. Office of the Governor Secretary of State RIgov Elected Officials State Agencies A-Z State.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

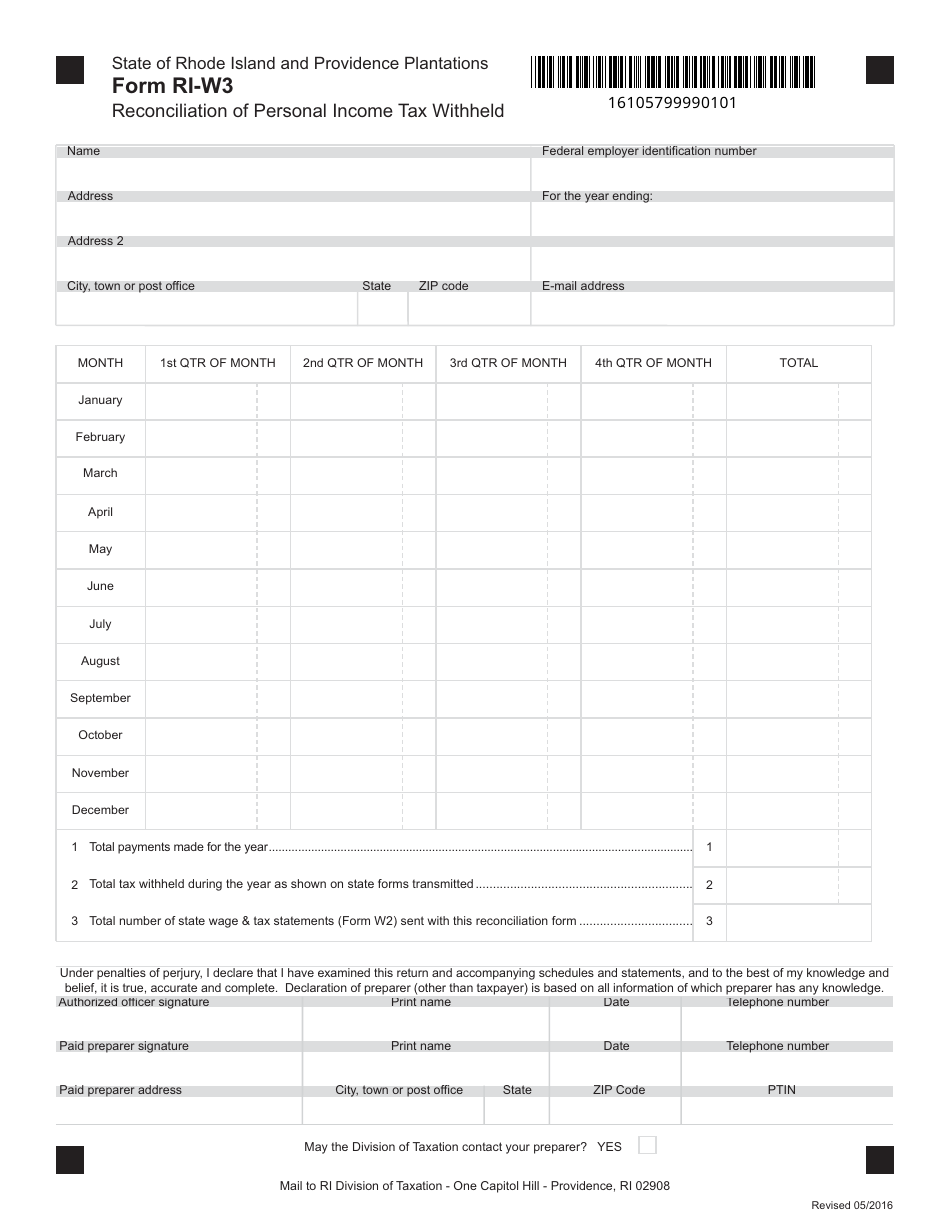

Form Ri W3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller

Rhode Island Income Tax Ri State Tax Calculator Community Tax

State W 4 Form Detailed Withholding Forms By State Chart

Where S My State Refund Track Your Refund In Every State

State Of Rhode Island Division Of Taxation Division Rhode Island Government

State W 4 Form Detailed Withholding Forms By State Chart

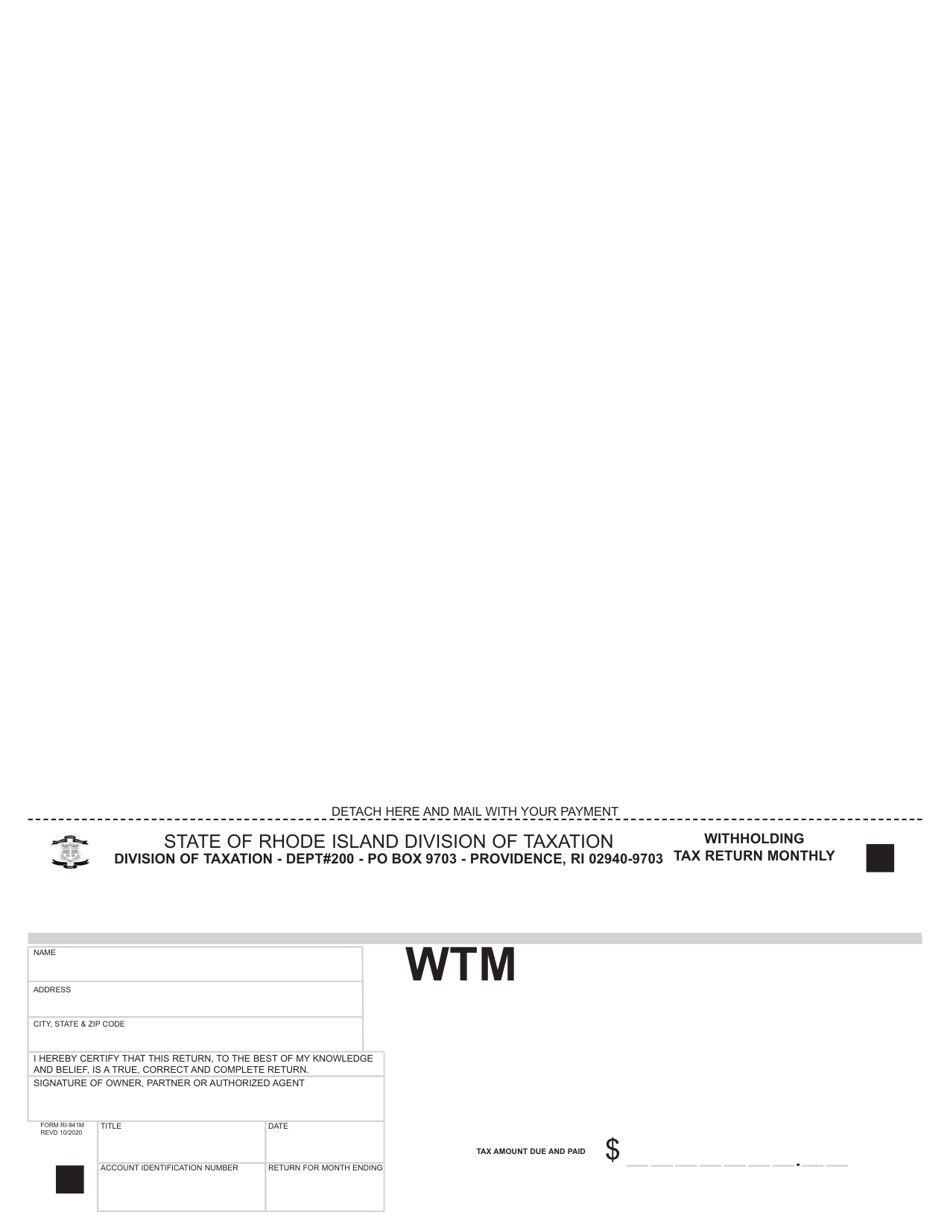

Form Ri 941m Download Fillable Pdf Or Fill Online Withholding Tax Return Rhode Island Templateroller

2020 Form Ri Ri W 4 Fill Online Printable Fillable Blank Pdffiller

State Of Rhode Island Division Of Taxation Division Rhode Island Government

State Income Tax Rates And Brackets 2022 Tax Foundation

Pin En Personal Financial Literacy For Ells

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

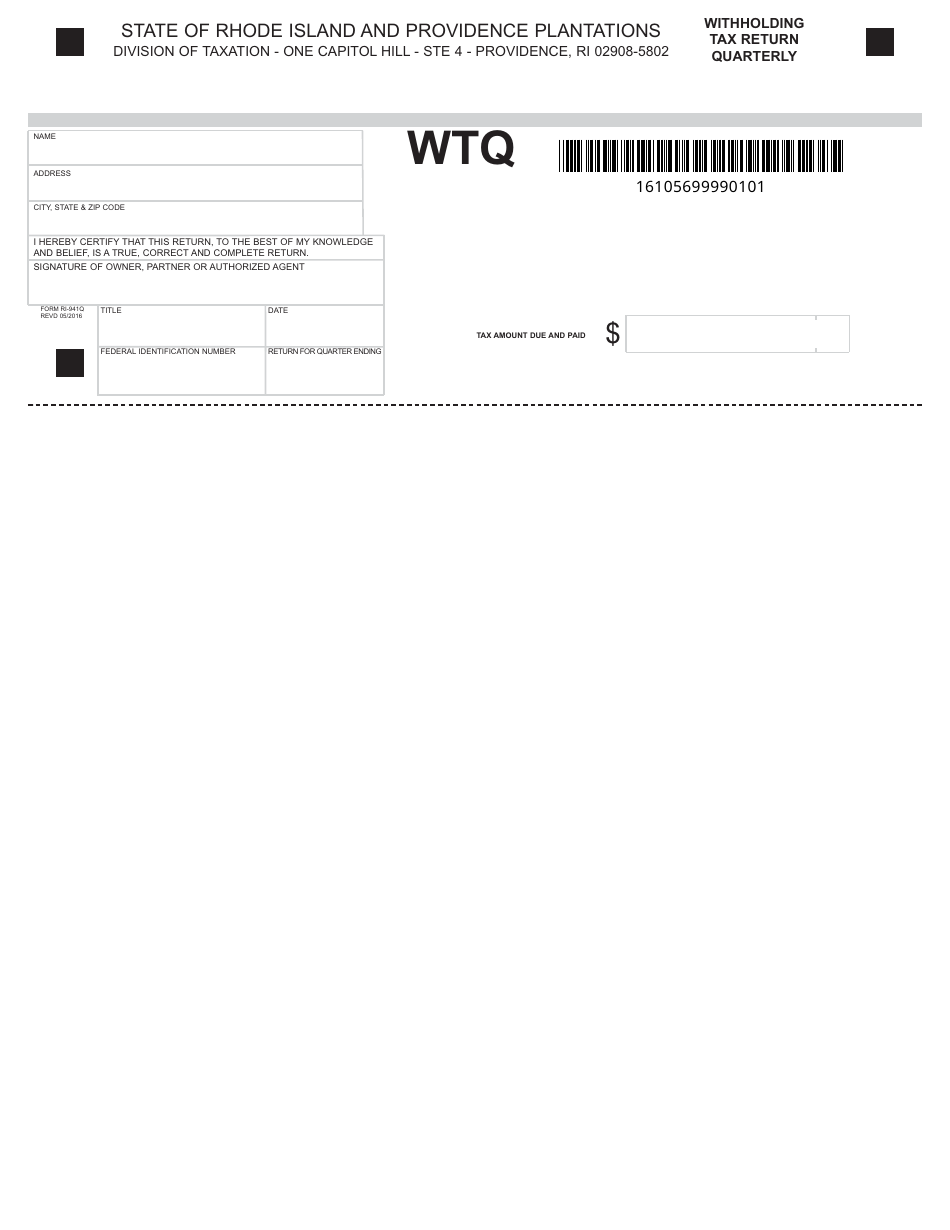

Form Wtq Download Fillable Pdf Or Fill Online Withholding Tax Return Quarterly Rhode Island Templateroller