reit dividend tax south africa

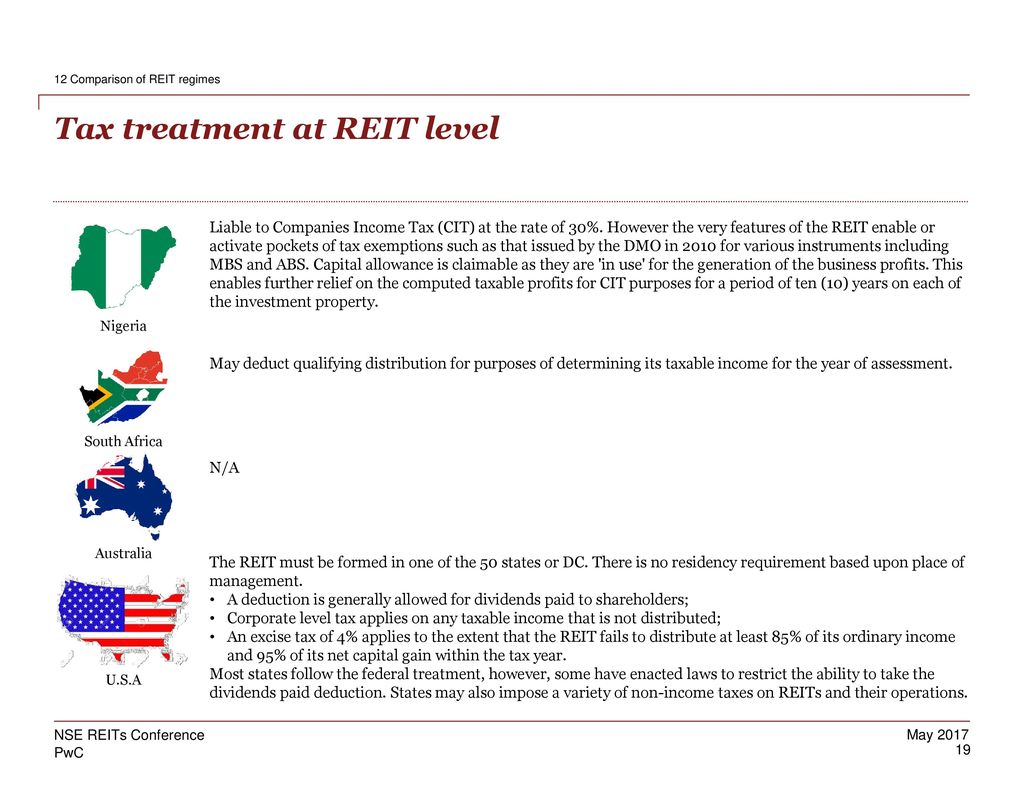

The Real Estate Investment Trust REIT tax regime in South Africa was addressed for general review in Annexure C. Such person will however be exempt from dividends tax in respect of such dividend.

Africa Tax In Brief February 18 2020 Tax South Africa

Dividends received from REITs are not exempt from income tax and will be.

. How Are Reit Dividends Taxed If Reinvested. As a REIT by its nature distributes most of its net income to its investors the REIT itself usually pays little or no income tax. A Real Estate Investment Trust REIT is a company that derives income from the ownership trading and development of income producing real estate assets.

Ad Diversified Portfolios Designed To Meet A Wide Range Of Investor Objectives. 58 Dividends Tax sections 64E1 64F1. Dividends received or accrued from a REIT are subject to 40 income tax in South Africa for trusts investing in REITs.

The REIT or controlled company may be able to deduct the deemed dividend as a qualifying distribution. Tax consequences for REITs. REIT dividends are not excluded from income tax and will be taxed in the hands of the beneficiary taxpayers.

However dividends are still subject to the 20 percent dividend tax which is paid by the person receiving. In turn this may result in the REIT or CC not being able to claim the dividend as a qualifying distribution deduction and ultimately the REIT or CC may be in a taxable income position. Dividend in specie is exempt from dividends tax but subject to income tax in the hands of the investor.

South African REITs own several kindof commercial s such asproperty shopping centres office buildings factories warehouses hotels hospitals and residential property in SouthAfrica. REIT Dividends - South African tax resident shareholders. The definition of a reit in the income tax act refers to a company that is a south african tax resident whose shares are listed on the jse as shares in a reit as defined in the jse limited listing.

Received by a non-resident from a REIT will be subject to dividend withholding tax at 15 unless the rate is reduced in terms of any applicable agreement for the avoidance of double taxation DTA between South Africa and the country of residence of the unitholder. Instead the shareholder pays income tax on the. A reduced dividend withholding rate in terms of the.

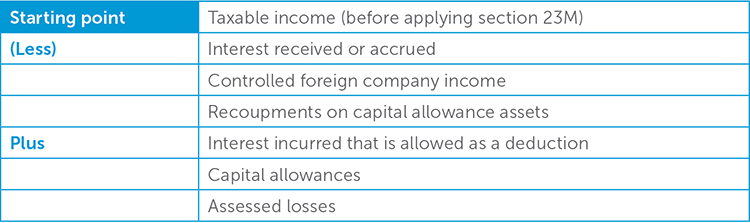

Tax consequences for REITs of foreign exchange movements COVID-19 South Africa. On dividends on REIT investments until they receive their pension payments for the funds. The limitation of interest deductions on reorganisation or acquisition transactions using a formula applies to the interest on a linked unit.

REIT Dividends received by South African tax residents must be included in their gross income and will not be exempt from income tax in terms of the exclusion to the general dividend exemption contained in paragraph aa of section 101ki of the Income Tax Act because they are dividends. AnnexureC also referred to the implementation of the Financial Sector Regulation Act No9 of 2017 and the establishment of the Financial Sector Conduct Authority FSCA which provide for the regulation of unlisted REITs as it is proposed that. Property owning subsidiaries of REITs also benefit from the section 25BB tax dispensation.

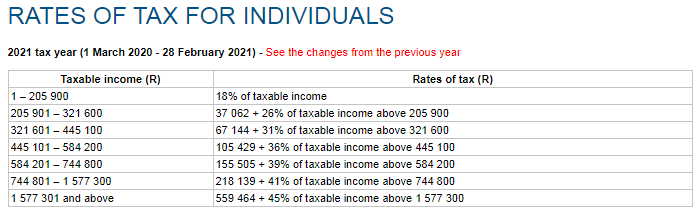

How Are Reits Taxed In South Africa. A South African tax resident natural person investing in a REIT will be subject to income tax on dividends received by or accrued from a REIT at a maximum rate of 40. Be subject to a 20 dividends tax which is in fact a tax on the investor.

In South Africa a REIT receives special tax considerations and offers investors exposure to real estate through shares listed on the Johannesburg Stock Exchange JSE. Interest distributions by a REIT or a controlled property company payable to South African resident investors are recharacterised as taxable dividends ie the normal tax exemption for dividends does not apply but dividends withholding taxes will not apply. This creates an issue that individual investors in REITs are not able to receive the benefit of the reduction in the corporate income tax rate due to the type of company they are invested in.

RE ITs may also invest in property in other countries. Recharacterisation of interest distributions. The major exemption though being dividends received from so-called REITs these being some of the major property owing companies listed on the JSE such as for example Redefine Properties Ltd.

Foreign shareholders of SA REITs are levied a dividend withholding post tax at the current rate of 20 but this can be reduced in terms of the rates set by the applicable double tax agreement between South Africa and the domiciled country of the investor. Dividend reinvestment however does not reduce or defer taxes on dividends. Ignoring commercial considerations in relation to this fairly common occurrence often the shareholders of the target company in these circumstances would be motivated for income tax reasons to rather sell the shares in the target company to the REIT as opposed to a sale by the target company of each of the immovable properties which may inter alia attract.

Real estate investment trusts REITs are subject to a special tax regime in South Africa. Pursuing Exceptional Outcomes With Rigorous Risk Management. Tax on dividends received by or accrued from a REIT will be imposed on natural persons who are South African residents.

Dividends received by a South African taxpayer are generally exempt from income tax. A reit and a controlled company must also consider dividends tax transfer duty securities transfer tax and vat. This in contrast to normal company earnings which are taxed at 28 within the company before 20 dividend withholding tax is applied to dividends paid out to investors.

58 of 1962s Income Tax Act Section 10 1 k i Although dividends from non-REITs are free from income tax this does not mean that dividends are not taxed at all. Dividends received or accrued from a REIT are subject to 40 income tax in. Put simply a REIT may deduct for income tax purposes distributions made to its shareholders.

Reit dividend tax south africa. The participation exemption exempts foreign dividends and capital gains from tax in South Africa provided that the South African taxpayer holds at least 10 of the total equity shares and voting rights in the foreign company declaring the foreign dividend or at least 10 of the total equity shares in the foreign company subject to the disposal.

U K Treasury To Raise 27 Billion More Tax Despite Sunak S Tax Cuts Bnn Bloomberg

Africa Tax In Brief February 18 2020 Tax South Africa

Reits Real Estate Investment Trusts And Tax Tax Worldwide

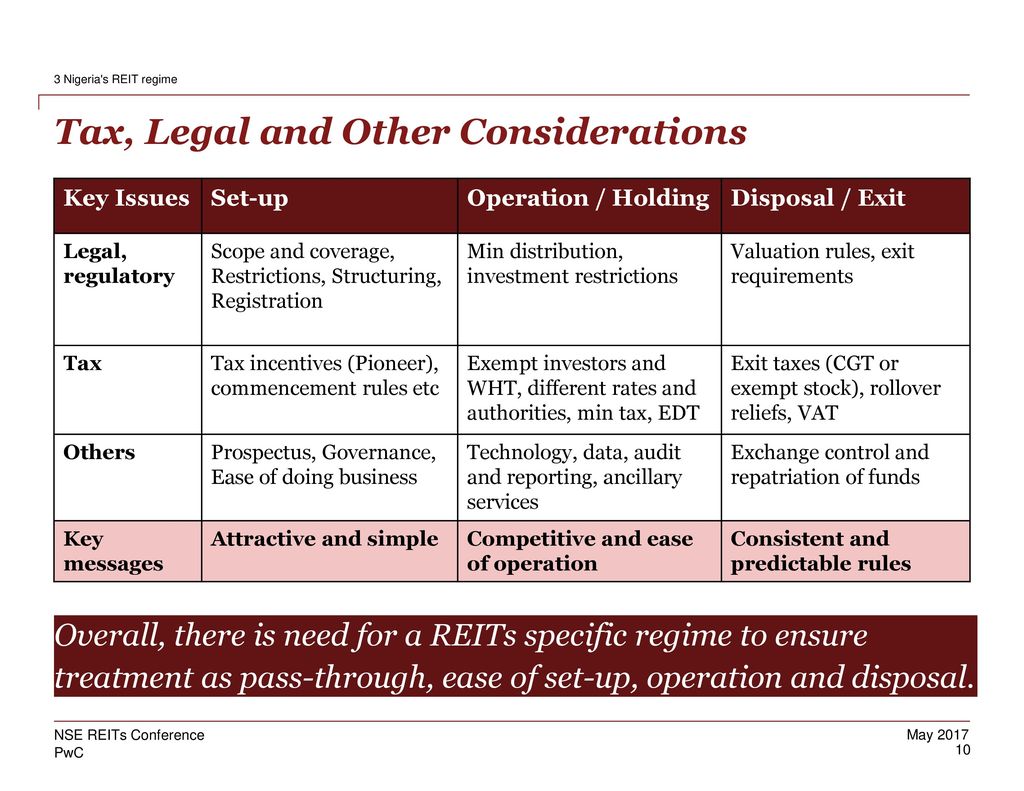

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

South Africa Tax Take Exceeds Budget Estimate For Second Year Bnn Bloomberg

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

Sa Reits Tax Benefits For Investors Sa Reit

Taxes Like Fees Can Eat Into Your Investment Returns

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

U S Stocks Have Become A Deflationary Asset Global Stock Market Stock Market Global Stocks

How Reit Regimes Are Doing In 2018 Ey Slovakia

Doing Business In Ireland Guide

Corporate Tax Report 2022 Italy

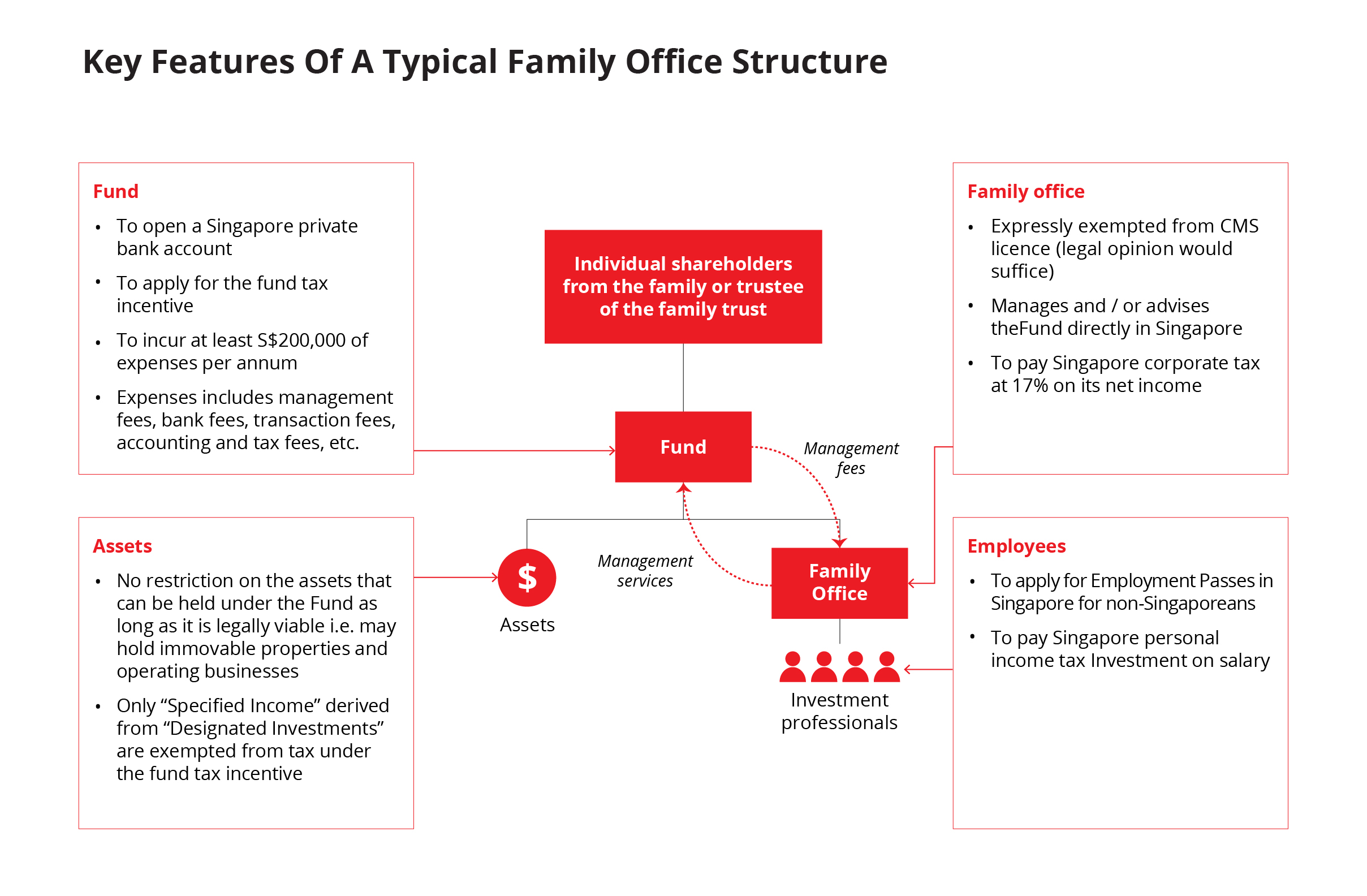

Single Family Office Singapore 13x Family Office Singapore Sfos

Cliffe Dekker Hofmeyr 2021 Draft Tax Laws Amendment Bill Welcome Relief For Reits

Stealthy Wealth On Twitter Your Total Income Is Taxed According To The Following Table Available On The Sars Website Here Https T Co Tu0ucbwfuy This Is For The 2021 Tax Year The One Which

Gainesville Fl Office Avison Young Us Real Estate Investing Real Estate Investment Trust Investing